Hello, welcome to the E8funding 2023 review. Here we explore the pros, cons and key features of this platform. E8funding 2023 is an online fundraising platform that connects investors with founders and start-ups looking to fund their projects. A user-friendly interface and advanced features promise a hassle-free fundraising experience. This review will help you determine the pros and cons of the platform and whether E8funding 2023 suits your fundraising needs. I'll describe the main features it's not.

What is E8 Funding?

E8 Funding is a trading company specializing in discovering the untapped potential within the community and providing innovative funding options for Forex and CFD traders worldwide. The company was founded on November 5th, 2021, and operates in Texas and Dallas.

E8 Funding has pursued new funding solutions to enable entrepreneurs to become professional traders. The professional path with E8 Funding is highly encouraged to help traders continue their success.

The organization demands a high level of discipline from its customers to manage risks effectively and ensure predictable outcomes. They can earn significant income from accounts of up to $1,000,000. Trading currency pairs, commodity indices, stocks, and cryptocurrencies can lead traders to earn up to 80% profit.

Pros:

- Unlimited free evaluation attempts

- Immediate access to your account

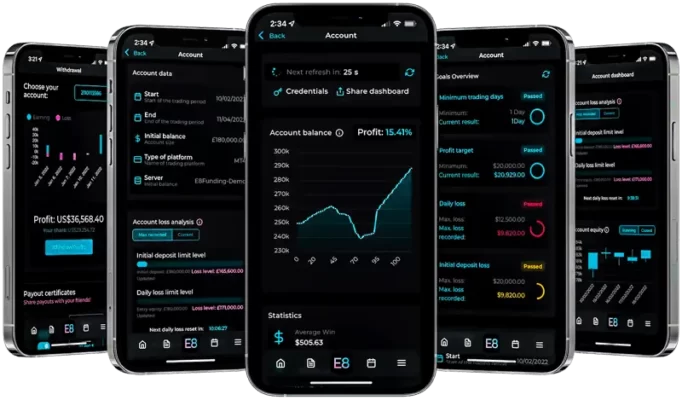

- An attractive and innovative trader dashboard

- Forex leverage of up to 1:100

- Maximum capital allocation on E8 accounts ranging from $250,000 to $600,000

- Accounts funded with up to $1,000,000 with a ratio

- Up to 80% profit sharing

- No minimum trading days are required for standard accounts

- Allows trading of news overnight and on weekends

- Trade on popular MetaTrader platforms

- Free demo available for testing.

Cons:

- The trading fees are not the lowest among prop trading firms.

- Support is unavailable 24/7.

- The maximum daily loss limit is set very low.

The key features of E8 Funding

The following are the primary features of E8 Funding, which is a provider of capital for international traders and has introduced significant innovations during its existence:

Quick registration

E8 Funding has developed one of the industry's swiftest and simplest registration procedures, taking just a few minutes to complete. Enter your particulars to receive login information once your payment has been approved. Then, your E8X dashboard will contain your login verification information.

E8X dashboard

Monitoring your trades and ensuring you work towards your goals has always been challenging. E8 Funding has strived to provide the most user-friendly experience possible for tracking all your trading history, targets, and rules. You can track all your account targets, achievements, and trade statistics with the E8X dashboard.

Brokerage

You trade with the liquidity provided by the company's liquidity providers. Through the E8 MT4 server, which is only used to collaborate with Tier 1 organizations, you can receive a minimum spread with the reliable commission and execution speed.

Platform

MetaTrader is one of the most widely used and respected trading platforms, providing all the trading tools required to construct your trading strategies. You can carry out in-depth market analysis and place and manage trades using a user-friendly interface. E8 Funding presently offers traders web MT4/MT5, iOS and Android applications, and desktop MT4/MT5 applications.

Instruments

Customers have a wide selection of financial instruments to choose from. You can trade Forex, Commodities, Indices, Stocks, and Cryptocurrencies.

| Maximum capital | $1,000,000 |

| Profit sharing | Up to 80% |

| Scalability | Yes |

| Trading news | Yes |

| Weekend trading | Yes |

| Automated trading | Yes |

| Free trial | NO |

| Maximum leverage |

E8funding Features

Review E8funding: Programs

To access managing an E8-funded account and start making profits, you must pass E8's two-stage funding evaluation process. To begin, choose the type of account you want to trade with, complete the mandatory application stages, and E8 will issue your account upon receiving payment. You will receive a confirmation email. Complete the evaluation process and be able to manage up to $300,000 within a week.

Account

By choosing an E8 or ELEV8 account, you will receive a demo account where you must trade by the company's policy for your selected product. With incredibly low commissions and spreads, your account conditions will be excellent.

Suppose you fulfill all the requirements of the first stage of the E8-funded account evaluation or the ELEV8 account evaluation. In that case, you will progress to the second and final stage.

In this final stage, you will receive a new account with considerably simplified rules before funding is granted.

| Account Types | E8 Account | ELEV8 program | E8 Track |

| Account Size & Fee | $25,000 (Fees: $228)

$50,000 (Fees: $338) $100,000 (Fees: $588) $250,000 (Fees: $988) |

$100,000 (Fees: $888) | $25,000 (Fees: $138)

$50,000 (Fees: $208) $100,000 (Fees: $358) $250,000 (Fees: $598) |

E8 Funding Size & Pricing

Funding process

The funding process involves a two-stage evaluation called the E8 account, which allows traders to choose a predetermined amount of capital to trade. To qualify, traders must complete Phase 1 and Phase 2 of the evaluation process by achieving the Trading Objectives. Once approved, traders receive an ELEV8 account with an initial balance of $100,000, which can increase by $100,000 every 30 days if they continue to meet the Trading Objectives and achieve a +16% profit target within a 30-day trading period. The trading balance will continue to increase by $100,000 every time the monthly profit target is met until the trader reaches $1,000,000.

Phase 1

The first stage of the trader evaluation process involves demonstrating the ability to trade reasonably and manage risk effectively. The profit target in Phase 1 is equal to the allowed withdrawal level, with policies called Trading Objectives that must be met within 30 days. Traders who follow risk management principles end up with a profit but do not achieve the profit target and can try again for free.

Objectives of Phase 1:

- Profit Objective 8% – Close the profit in your trading account.

- Daily Loss Limit 5% – Maximum owner's capital loss (floating drawdown) within 24 hours from CET time.

- Maximum Loss Limit 8% – Maximum owner's capital loss from your initial balance.

- Minimum Trading Days: 1 – Trade at least 1 day in the period. A trading day is counted when you close an open position within 24 hours of ET time.

- Maximum Trading Days: 30 – This period starts when you open the first trade on the account.

Phase 2

The final stage of the trader evaluation process and the profit target is halved from Phase 1. The objective of Phase 2 is to test the trader's ability to trade finances over a more extended period while adhering to the regulations and maintaining their capital. Traders have 60 days to complete the Trading Objectives in Phase 2, and upon completion, they can begin trading their funded account.

Objectives of Phase 2:

- Profit Objective of 5% – Close the profit in your trading account.

- Daily Loss Limit of 5% – Maximum owner's capital loss (floating drawdown) within 24 hours from ET time.

- Maximum Loss Limit of 8% – Maximum owner's capital loss from your initial balance.

- Minimum Trading Days: 1 – Trade at least 1 day during this period. A trading day is counted when you close an open position within 24 hours of ET time.

- Maximum Trading Days: 60 – This period starts when you open the first trade on the account.

E8 Accounts

Traders who choose the account size can access the company's liquidity directly through E8 Accounts. Upon passing the two-stage evaluation, traders receive funding and retain 80% of their generated profits while assuming the risk.

ELEV8 Accounts

ELEV8 is the funding method for consistently profitable traders. Bypassing the two-stage evaluation process, traders can receive their funded ELEV8 accounts. The account size increases by $100,000 every 30 days if traders achieve profit targets, and they can keep up to 90% of the earned income on the account.

Funded E8 Accounts

Funded E8 Accounts are simulated trading accounts that offer traders an 80% profit split. The company takes on all the risks while retaining 20%. After funding their accounts and agreeing to the trader's terms, the company links the trader's account with their direct trading account with real money.

When signing up as a funded E8 trader, they trust your skills and work hard to provide the best trading conditions. As there are no profit target obligations, traders are free to make their own trading decisions. However, they must adhere to the Daily Loss Limit and Maximum Loss Limit and exercise caution during important news releases.

E8 Performance Account

Traders who have demonstrated their capital management skills and are willing to undergo an additional evaluation stage can opt for the E8 Performance Account, a 3-stage assessment with lower entry costs. The key difference between the two evaluation methods is the extra assessment stage in the E8 Performance Account.

Traders are permitted to retain 80% of the profits earned on their funded E8 Performance Account after each trading period, provided they adhere to the Account Objectives and Rules. The remaining portion of their profit split will be eligible after every 14 days. After 8 trading days, the first payment will be available for withdrawal, and traders can withdraw their funds anytime.

The E8 Performance Account provides the standard E8 Scale. The fee for the E8 Performance Account is refundable upon the first withdrawal. Traders can keep their closed profits against their balance even after withdrawal, basing their account size on their performance and pace.