Overview

Trading 212 is a CFD broker regulated by the UK FCA, Bulgarian FSC, and Cypriot CySEC. Trading 212 provides commission-free stock and ETF trading. Account opening is fully online, straightforward and quick. Trading 212's web and mobile trading platforms are well designed and easy to use. It is a good choice for beginner investors. On the negative side, the product portfolio is limited, and some popular asset classes such as options or bonds are missing. Forex fees are quite high and the lack of USD as an account currency can make US stock trading costly due to conversion fees.

Trading products

Trading 212 offers over 1800 tradable assets, though this varies by account type. Nonetheless, investors can access 1500+ stock CFDs, 170+ currency pairs, 35 stock index CFDs, 25 ETF CFDs, and 28 commodities. Trading 212 retail clients can also invest in real stocks and ETFs. This includes access to more than 8500 stocks. You can also trade fractional shares with as little as £1, which is ideal for beginners or those with limited capital.

In 2021, Trading 212 restricted its offering of cryptocurrency trading, following the prohibition of the sale of the asset to retail clients set by the Financial Conduct Authority (FCA). This included removing opportunities to trade Bitcoin, Ethereum and Ripple. At the moment the brokerage still does not offer access to any form of crypto investments.

Account Type

Trading 212 accounts can be opened from anywhere in the world. However, there are some exceptions, such as clients from the United States or Canada being unable to open one.

There are three account types offered by Trading 212, CFD account, Invest account, and ISA account, each of which differs in terms of the offerings available for trading and the countries in which they are available. Below is a comparison table between the three of them.

| Account | CFD Account | Invest Account | ISA Account |

|---|---|---|---|

| Available Assets | CFDs | Real stocks & ETFs | Real stocks & ETFs |

| Available Countries | All countries available on Trading 212 | All countries available on Trading 212 | UK |

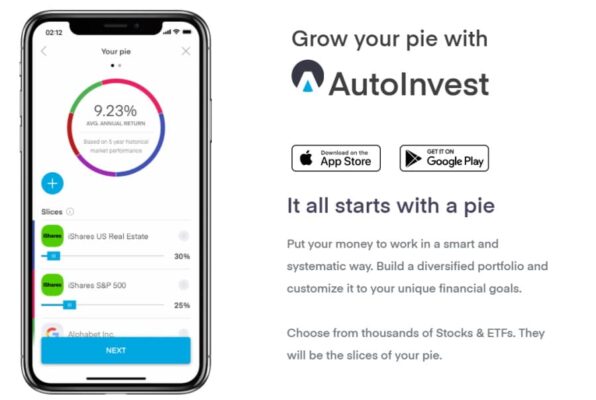

Mobile trading apps

The Trading 212 app is undeniably popular, with over 10 million downloads on the Google Play store. The app integrates educational video content for beginners, but experienced traders will find the lack of advanced features to be disappointing – especially when compared to the best mobile trading apps.

Apps overview: Trading 212 offers an incredibly easy-to-use mobile app for Android and iOS devices. The default watch list screeners make it easy to sort through markets such as stocks, forex, indices, and newly added symbols.

The biggest drawback I could find in the Trading 212 app is the lack of substantial research tools. It does have a robust economic calendar that conveniently highlights upcoming events for any given symbol.

Ease of use: Trading 212 is the first broker I have reviewed that also has its own Google chrome plugin, which provides quick access to the platform from within the browser. It’s also worth noting that its watchlists are customizable and automatically sync with the web platform. These features helped earn Trading 212 a Best in Class ranking (top 7) for Ease of Use in our annual review.

Charting: There are 45 indicators and 19 drawing tools that have been cleanly integrated into the app’s charting tool. The mobile app has near-identical functionality to the corresponding web version.

Trading tools: Unfortunately, good-till-date order expirations are not currently available and instead default to good-till-cancel. These kinds of subtle details illustrate how much room there is for the app to improve its customization options.

Upcoming events: One feature that stands out in the Trading 212 mobile app experience is the ability to see upcoming events when you are looking at the symbol properties of a particular instrument such as the EUR/USD. The event is displayed along with its potential impact, expected forecast, and exact time. One thing I would note: It would be nice if you could subscribe to and receive alerts about any given event – a functionality I’ve observed on CMC Markets’ trading platform.

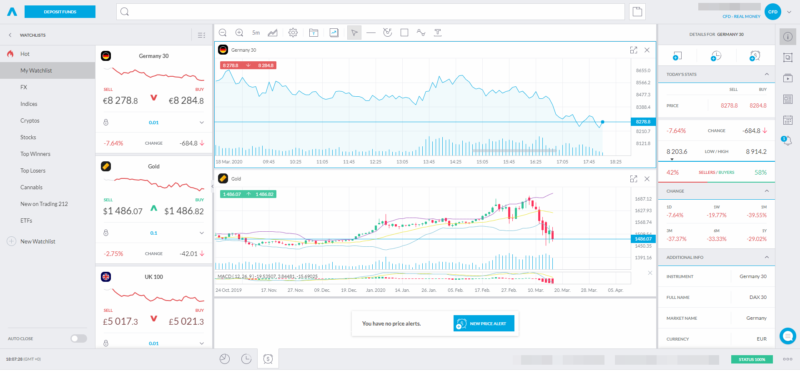

Other trading platforms

Platforms overview: Trading 212 offers a web-based trading platform, as part of its multi-asset offering. As with its other platforms, you’ll gain access to both of its accounts – CFD and Invest – and their respective markets. Most of the platform’s features are easy to use and it boasts a clean, simplified layout that includes robust charts and integrated news headlines.

One useful feature that Trading 212 shares with eToro: the website will cache a user’s credentials locally, so that they are automatically logged in when they access the platform via their browser.

Charting: Trading 212’s web platform – like the mobile app – features solid charting. You can choose from five different types, and you’ll gain access to 45 indicators alongside 19 drawing tools. You can create and save your own chart templates – a feature which I’ve found helpful when applying settings across a variety of charts. One noteworthy – albeit small – limitation: you can open multiple charts and switch between them, but you cannot detach the chart from the platform.

Trading tools: The web platform is missing the mobile app’s useful tool that allows you to discover upcoming events simply by glancing at the symbol of a given instrument. Rather, you have to do it the old-fashioned way and manually open the economic calendar to view those events.

Trading 212 Fees & Commissions

Fee

A Trading 212 Invest account allows you to trade stocks and ETFs completely free of charge. Just bear in mind that if the stock/ETF is in a different currency than your base one, you will incur a 0.15% currency conversion fee for each transaction.

When you deposit money via a debit/credit card or digital wallet, you will pay no fees until the total deposited amount reaches EUR 2000, but a 0.7% fee will apply thereafter. Note that you will have to deposit at least 10 euros each time for Trading 212 to accept it.

If you must deposit a large amount, it may be less expensive to wire transfer which will cost 10 euros instead. But check on what your bank charges for wire transfers before you go with this option.

There are no withdrawal fees for this account type.

Commissions

If you go with a Trading 212 CFD account, the transaction cost for Forex will depend on the underlying pair as each one has a different spread. But the broker charges a standard 0.5% conversion fee.

You will not be charged anything for depositing funds but a minimum deposit amount of 10 euros is required.

If you leave a position open overnight, you will be charged an interest SWAP.

Payment Methods

Deposit and withdrawal

When depositing money into your account, it’s free with a bank transfer, and these are instant too.

You can also deposit by card (and Google pay), and this is free up to £2,000. After that it’s 0.7%.

There’s no withdrawal fees either, or inactivity fees (which you can find on other platforms).

Asset on Trading 212

Trading 212 Invest

With Trading 212 Invest, you can trade stocks and ETFs for free. Its offerings here may not be as many as other online brokers offer, but there are thousands of them so chances are you will find what you’re looking for; especially if it’s listed on a major exchange.

Trading 212 CFD

With Trading 212 CFD, you get access to CFDs (contracts for difference) which are the type of asset that Trading 212 started offering when it was founded back in 2005.

You can buy CFDs on forex, stocks, indices, and commodities. The assets available for CFD trading are thousands.

Note: A contract for difference is an agreement between a buyer and a seller that stipulates that the buyer or seller will pay the other party the difference between the opening and closing price of an underlying security.

Who pays whom is determined by the direction of the underlying security’s price. If you buy a CFD on a stock that you think is going to appreciate in value, whoever sold you the CFD will have to pay you the difference between the price the stock was trading at when you bought the CFD and the price it had when you closed your position.

No problem if you don't want this. I just thought that it may be useful for beginners.

Customer Support

Customer support on Trading 212 is very good both in regards to their process for resolving your issue and availability.

You can get in touch with them via live chat or email. Phone support is not available, unfortunately. The bright side is that you can contact them 24/7.

Just bear in mind that you will be asked to fill out a form if you require support through email. But that’s good since your question can be answered by going through the relevant articles that will be recommended once you fill out the form.

FAQ

Is there an inactivity fee on Trading 212?

No. trading 212 does not charge its clients an inactivity fee.

How does Trading 212 make profit?

The spreads between the buy and sell prices on Trading 212's assets are how they generate money. In addition, there is a 0.5% currency conversion fee, as well as stamp duty on ETF and share purchases.

Does Trading 212 make me own my shares?

Trading 212 holds the shares clients have on their behalf. The equity is held in custody at Interactive Brokers when you invest with Trading 212. These are among the largest brokers in terms of daily trades, with $160 billion in client assets.

Can I create more than one trading account?

On Trading 212, you can’t create and maintain 2 active accounts using the exact same information. If you are a UK-based client, you get to use the same email address and name to open a, CFD, Invest, and ISA.